- ABOUT TELENOC

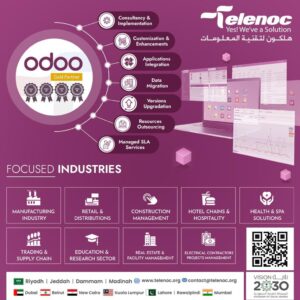

- SERVICES

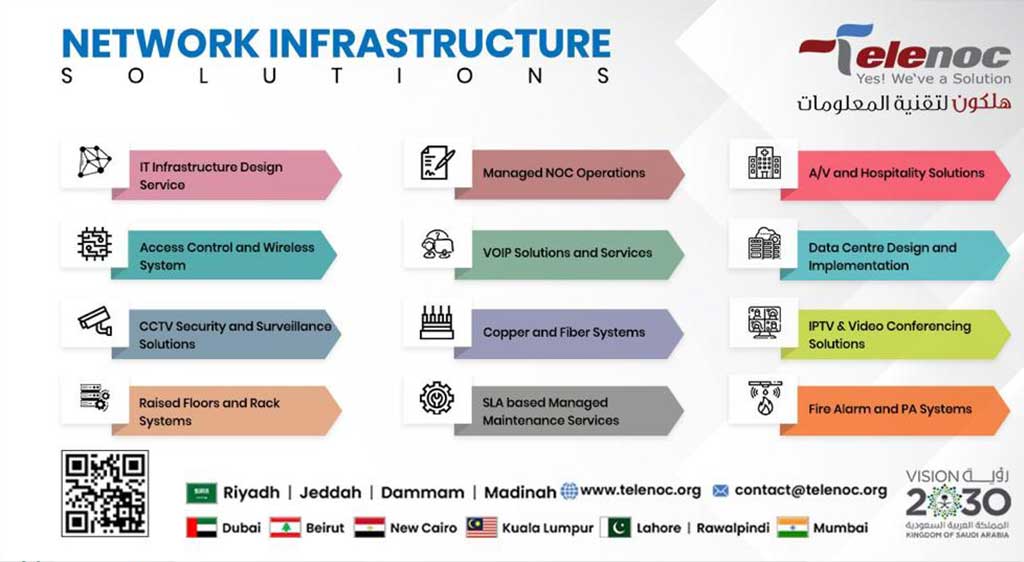

- IT Infrastructure Services

- Managed NOC Services

- Managed IT Services

- Thermal CCTV & Sanitized Gates

- Data Center Design & Implementation

- CCTV Security & VOIP Solutions

- Access Control & Wireless Systems

- IPTV & Video Conferencing Solutions

- Raise Floors & Rack Systems

- Copper & Fiber Systems

- A/V and Hospitality Solutions

- Fire Alarm & PA Systems

- Backup & Storage Solutions

- Cyber Security Governance

- Managed SOC Services

- Cyber Forensics Services

- Cloud Security Services

- Identity & Access Management

- Risk/Maturity Assessment

- Legacy Archiving Consultancy

- Managed Security Services

- Data & Network Security

- Applications Security

- Endpoint & Server Security

- Sayen: Digital Secured Sign

- Emdha: Digital Secured Sign

- PRODUCTS

- PORTFOLIO

- CONTACT US